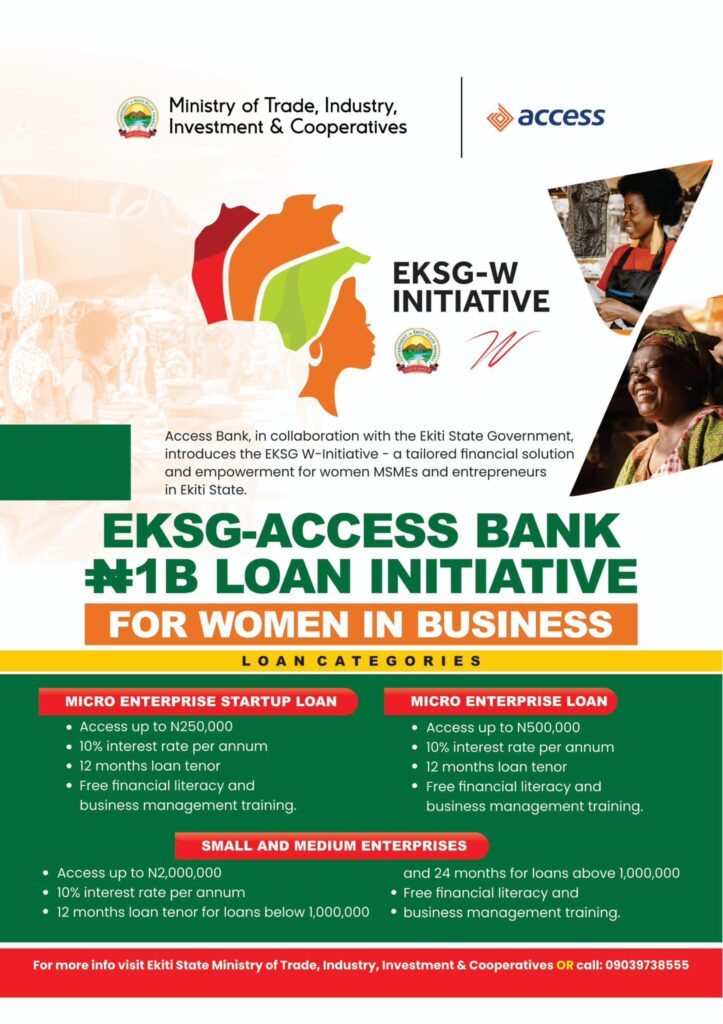

Ekiti State N1 Billion Loan For Business Women

The loan initiative is targeted at providing working capital for businesses owned and operated by women in Ekiti State. See below:

𝐖𝐇𝐀𝐓 𝐘𝐎𝐔 𝐒𝐇𝐎𝐔𝐋𝐃 𝐊𝐍𝐎𝐖 𝐀𝐁𝐎𝐔𝐓 𝐓𝐇𝐄 𝐄𝐊𝐒𝐆/𝐀𝐂𝐂𝐄𝐒𝐒 𝐁𝐀𝐍𝐊 𝐖𝐎𝐌𝐄𝐍 𝐋𝐎𝐀𝐍 𝐈𝐍𝐈𝐓𝐈𝐀𝐓𝐈𝐕𝐄 𝐅𝐎𝐑 𝐖𝐎𝐌𝐄𝐍 1. The loan initiative is targeted at providing working capital for businesses owned and operated by women in Ekiti State.

2. The loan categories are Micro Enterprise Startup (MES), Micro Enterprise (ME) and Small & Medium Enterprise (SME). 3. Micro Enterprise Startup (MES) targets women who have completed vocational training and are ready to kickstart their businesses. Applicants can access a maximum of N250,000 under this loan category and do not require business registration (CAC) to apply.

4. Micro Enterprise (ME) targets existing businesses that require working capital to upscale their business and penetrate new markets. Applicants can access a maximum of N500,000 under this category and do not require business registration (CAC) to apply. 5. Small and Medium Enterprises (SME) target registered business entities that require working capital to expand their businesses. Applicants can access N2,000,000 or more if they provide business projections and documentation to support their request. 6. All loans under this initiative are provided at a 10% per annum interest rate.

7. SME loan category is the only category that requires a business registration certificate (CAC). 8. Applicants will undergo a credit check during the loan processing to ensure they are not bad debtors and are either debt-free or actively repaying other loans. 9. The minimum Grade Level for Guarantors is Grade Level 6 for Civil Servants in EKSG and other Federal Government Parastatals.

10. Successful applicants will be directed to undergo account opening at any Access Bank Branch in Ekiti State. 11. All beneficiaries will undergo compulsory Business and Financial Literacy training before receiving funds. 12. Beneficiaries’ accounts will be credited immediately after account opening, but funds will be held until the beneficiary completes the mandatory 2-day business and financial literacy training.

13. The Micro Enterprise Startup (MES) and Micro Enterprise (ME) loan categories are targeted to provide loans to unregistered businesses. Loans will be granted even if the applicant’s business is not registered with CAC or does not have a business bank account. 14. Applicants for MES and ME loans will be assessed based on their 6-12 months personal accounts’ turnover, as many businesswomen use personal accounts for their business activities.

15. Businesses owned by at least 30% women shareholding, managed by women, or producing products solely for women can also apply. 16. To register, visit the Ekiti State Ministry of Trade, Industry, Investment, and Cooperatives.

I need money to add to my business order to make more stable

I need the loan to boost my business

I have chemist shop

How do we apply for this loan

I’m willing to Apply

I wish to benefit in the Ekiti state #1 billion

I want to obtain the loan so that I will be able to get my daily needs

I need the money to boost my business,am selling shoes and cosmetics

I am a fashion designer and I also sell tailoring materials and accessories.

Thanks to the government for this great privilege given to me to participate in this business loan initiative, it is a rare privilege.

Ensure you apply for it.

Thanks in anticipation.

I will be grateful if I am consider for the loan

Apply for it.

I need it to boost my business